Sounds like a dream, right? But it is completely possible with the right investment strategy and a little patience. In this blog, let us see how a simple Systematic Investment Plan (SIP) backed by the average return on mutual funds can make you a crorepati. Let’s get into it:

What Is SIP?

A Systematic Investment Plan, or SIP, is one of the easiest ways to invest in mutual funds. You pick a fixed amount, say ₹1,000 or ₹5,000 and invest it every month. That’s it.

It is flexible, beginner-friendly, and perfect for long-term wealth building. You don’t need a big lump sum or perfect timing. You can start small, increase your amount later, or even pause when life gets unpredictable.

What makes SIPs extra powerful is that they turn investing into a habit of saving. And over time, they let you benefit from rupee cost averaging and the magic of compounding.

Think of it this way- A SIP is like watering a money plant every month. It may not look like much in the beginning. But give it time, and you will have a full-grown tree of wealth.

What Is The Average Return On Mutual Funds In India?

When we talk about mutual fund investments, one question always pops up: “How much return can I really expect?”

It depends on the type of fund – equity, debt, or hybrid. But among them, equity mutual funds usually deliver the highest returns, especially when you stay invested for the long run.

AMFI (Association of Mutual Funds in India) provides all the essential information about mutual funds in the country. Based on historical trends, the average return of Indian mutual funds is 12%, especially when held for 10 years or longer.

Now, why does this matter to you as an investor? Because knowing the average return on mutual funds helps you plan better. You won’t have to guess but you will know how much your money can grow.

For example, investing ₹3,000 per month for 10 years at a 12% average annual return can grow to over ₹7 lakh. That is more than double what you put in. Just by staying consistent and giving your money time, you can see the magic of compounding.

How ₹5,000 Turns Into ₹1.76 Crore?

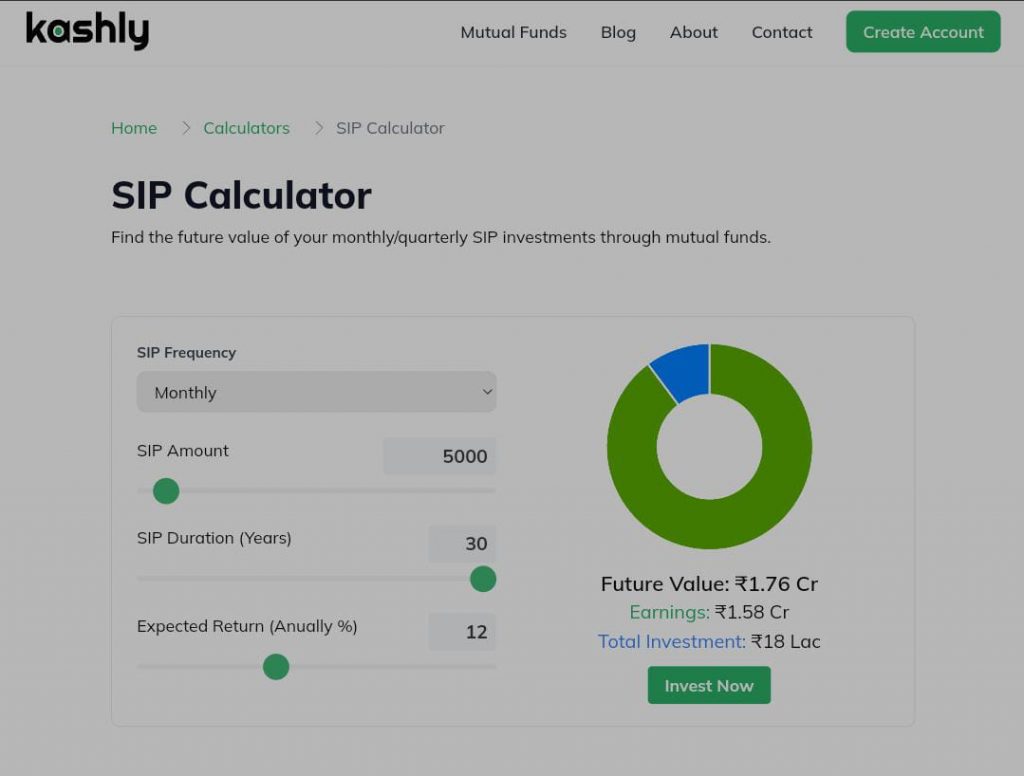

Let’s see how the numbers work using the Kashly SIP Calculator. It only takes a few seconds to enter the details, but the result might just surprise you.

If you invest ₹5,000 every month for 30 years, and your mutual fund gives an average return of 12% annually, your total investment of ₹18 lakh can grow into a massive ₹1.76 crore. That is ₹1.58 crore earned purely as return. All thanks to compounding and consistency.

Yes, you read that right. That humble ₹5,000 you set aside every month? It quietly grows until it becomes a life-changing corpus. No guesswork. No stress. Just smart, steady investing.

Are you looking for investments?

Kashly team can help you start your mutual fund investments with professional guidance.The Earlier, The Better

When it comes to building wealth, starting early beats starting big. That is because the longer your money stays invested, the more time it gets to grow.

Even if ₹5,000 feels small now, it multiplies into something significant over the years. On the other hand, if you wait until your 40s to begin, you will need to invest a much larger amount every month to reach the same corpus. So instead of waiting for the “perfect time,” start today. Because the longer you stay, the stronger your returns.

It is easy to start a SIP, but staying consistent is also important. Here are a few simple tips to help you stick to your plan:

- Set Auto-Pay and Relax: Turn on auto-pay for your SIPs. So the money gets invested automatically every month. No reminders, no delays, but stress-free investing while you focus on everything else in life.

- Treat It Like a Monthly Bill: Think of your SIP like something you can’t skip. Treat it as a fixed, essential expense. It should be a habit, not a choice. That is how wealth quietly builds in the background.

- Review Regularly: Markets will rise and fall. But don’t panic. Review your investment and make adjustments. Trust the process and let your SIP grow quietly in the background.

- Top It Up With Income Hikes: Got a raise or bonus? Then increase your SIP by even ₹500. Small boosts can lead to big gains over time.

- Define Your Goal: Give your SIP a purpose. Is it a dream home, early retirement, or your kid’s education? Name your goal. Because, having a clear goal keeps you motivated.

Final Words: Small Steps, Big Future

You don’t need to be rich to build wealth. A SIP of just ₹5,000 a month backed by the average return on mutual funds, can quietly snowball into something massive over time. All it takes is a simple saving habit, discipline and a little patience.

So why wait? Start your investment journey with Kashly and watch how simple habits create extraordinary results. http://kashly.in.

Happy investing!